installmt is more than payment processing. We constantly innovate to keep your borrowers engaged and grow your business’s top and bottom lines.

Next-Generation Tools that

Innovate your Lending Operations

Autopay of the Future

installmt smart autopay leverages smart automation to ensure more payments are made on time. installmt autopay quickly & automatically adjusts loan payment dates toward income dates and away from large expenses. It makes a huge difference in your operations, just look at our results:

by the numbers

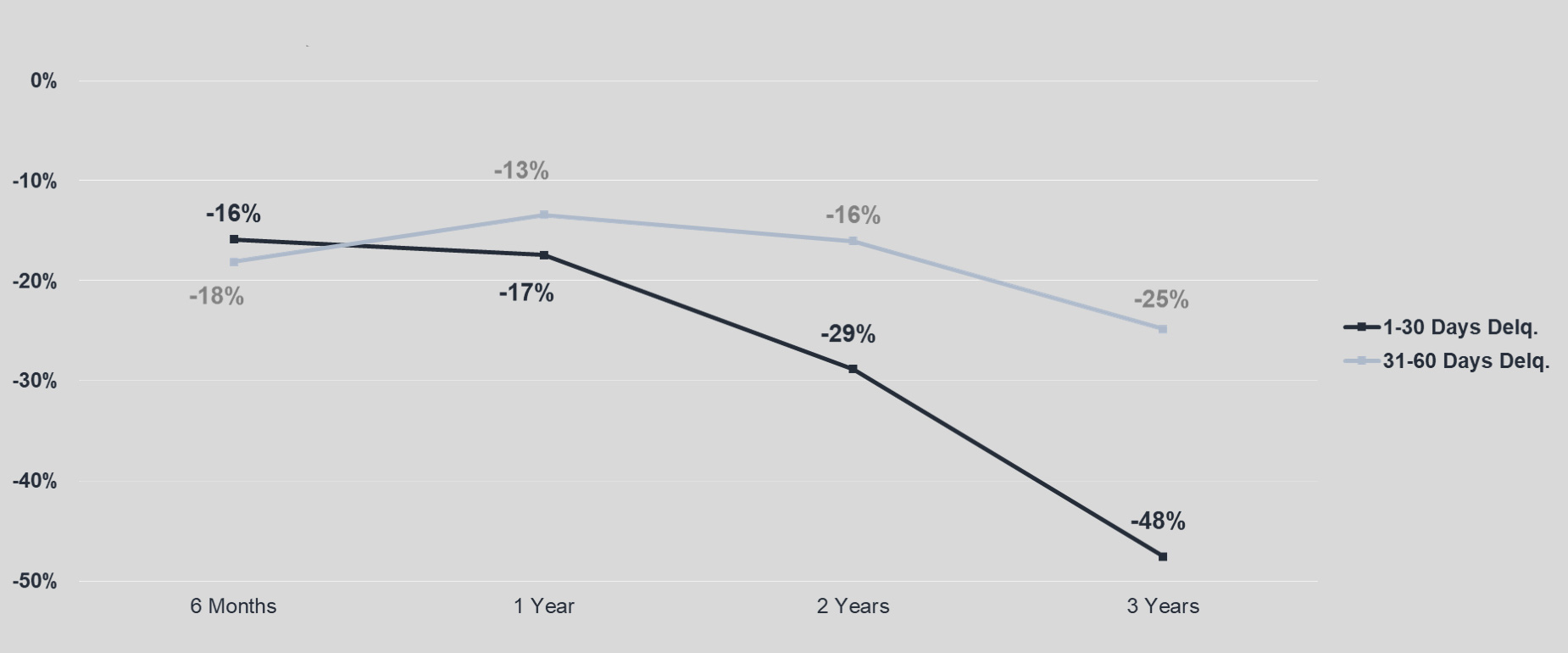

Delinquency Drops over Time

Real, active results from our clients show consistent, double-digit improvement in short-term delinquency. Interestingly, as these offices used installmt over time, this improvement compounded year-on-year. As businesses continue to use our platform, borrowers increasingly make on-time payments.

by the numbers

Staff can Spend 3x More Time per Loan on Collections

Data collected since the launch of installmt shows us that 66% of approved payments were from autopay with zero human intervention required. We call these “No-Touch” payments. By eliminating focus by employees for 2/3 of every payment, staff can spend 3x as much time on the loans that require collection attention.

Integration with Loan Management Systems

We make it easy to use installmt

- Automatically post payments

- Payment checkout directly in LMS screens

- External online payment portal directly connected to LMS server

- Automated tools interact with LMS to compound benefits

More Next-Gen Tools are On The Way

Future development priorities fall under at least one of these criteria:

Improve key metrics for lenders:

Ensure borrower financial stability through loan repayments or improve borrower experience with lenders

Help us Build the Next Generation of Lending

We build tools for the needs of current clients. By working with installmt, our team is dedicated to making your business better.